About Us

about us about us

, a multifunctional design studio, where crafting design that provides modern solutions to turn the visions of our clients into reality is our job. We are here to help you express yourself in the most artsy and creative way.

Stage Style has been excelling in the design world for over 14 years, providing innovative and cutting edge solutions every single time. Each project is unique for us, that is why we strive to design specifically for you, based on your needs and preferences without forgetting ergonomics and technical aesthetics, of course.

The CEO and Founder of Stage Style is Bagrat Divanyan.

Creative

In order to design anything at all you need creativity. In order to be an outclassing specialist at Stage Style, you need a lot of it. Our team has a creativity overdose that is contagious for all of our customers.

Fast

We value your time and thus provide an outclassing quality design services in a timely manner that will leave you with nothing other than pure satisfaction. Promptness along with excellence is our forte.

And Furious

Fast can’t go without furious. We make the best out of this quality and have a team full of extremely passionate individuals ready to provide the most innovative solutions for all our customers.

Interior/Exterior Design

Whether you are moving into a new apartment, transferring to a new office or building your house from scratch, Stage Style offers design, in which creativity meets ergonomics in a unison. Trust our interior and exterior designers to create a space that will enhance your taste, convenience and modern trends.

Event Design

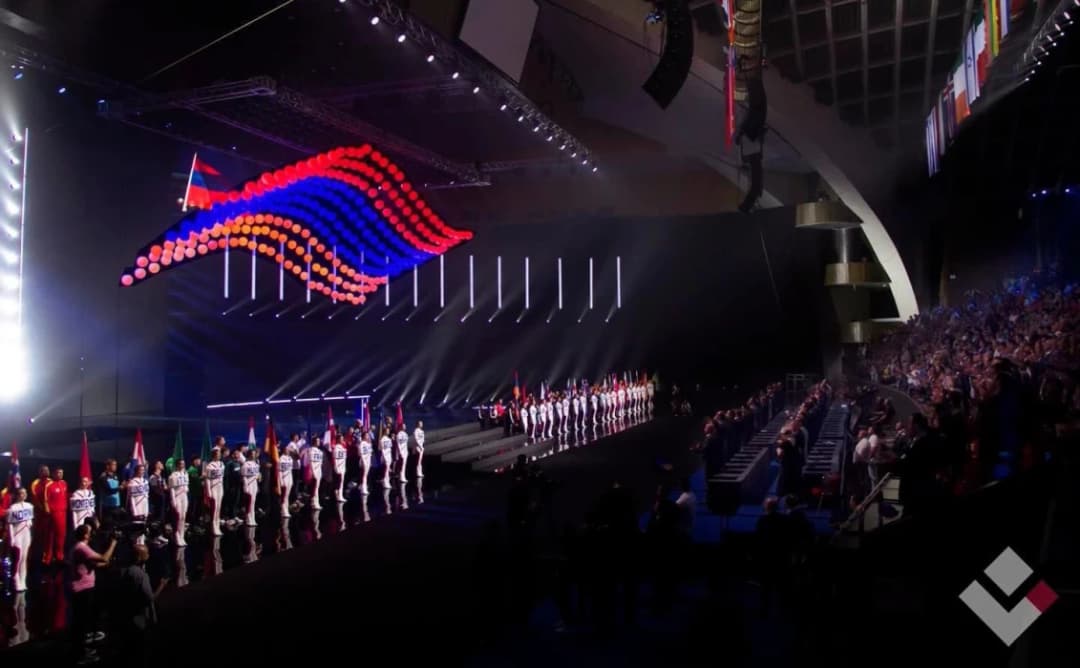

Every special occasion needs to be accompanied by a setting that matches the event. Grand openings, sport events, product launches and any other occasion can be professionally and creatively designed by Stage Style.

Stage Design

Stage Style is specialized in designing theatrical scenery that is able to impress the audience and engage them in the performances. Stage design is a key component for the success of any theatrical play with its ability to create the right atmosphere to capture the attention of all attendees.

Branding/Graphic Design

Your brand is what makes you stand out in the competition. Stage Style provides the most innovative solutions when it comes to brand identity. From a single logo concept to its realization and beyond, our talented graphic designers will take your entire branding under control.

Furniture Design

Perfect atmosphere of any space requires equally perfect furniture. We at Stage Style do not only design the most modern looking and unique pieces of furniture, but also make them for you in our factory in a timely manner.

Our Work

Read More

Junior Eurovision 2022

Read More

New Year decoration

Read More

Transforming Karen Demirchyan Sports Complex into a stunning wedding venue.

Read More

“Khazer” Awards

Read More

Paylow

Read More

New pavilion is in progress !

Read More

Read More

The Men's 2022 European Boxing Championships

Read More

տաղավարը Հանրային հեռուստաընկերության համար

Read More

H2Օ Emotional Exposition by KIVERA NAYNOMIS

Read More

65th anniversary of the Armenian Public TV

Read More

The Independence Day of Armenia

Read More

Canticle Of Canticles

Read More

EXPO 2020 DUBAI

Read More

Junior Eurovision 2021

Read More

ChainPoint 19 Conference

Read More

To Eurovision

Read More

“Weak Link” pavilion

Read More

News of the First Channel

Read More

The Armenian Genocide Centennial

CUPS OF COFFEE

PROJECT DONE

PROJECTS IN PROGRESS

CONTACT US

We’re happy to satisfy your curiosity